Delta Exchange India Guide 2025: Best for Crypto Trading in India

🎁 Save 10% Fees on Delta Exchange

For the next 2 months, you can enjoy a 10% discount on trading fees at Delta Exchange. Simply Sign Up with Code YIGRBW.

✅ Trusted FIU Registered | 💰 Lowest Trading Fees in India | 📱 Easy INR Deposit & Withdrawal

The interest in digital assets such as Bitcoin, Ethereum, and altcoins has led to the surging popularity of cryptocurrency trading in India. With the availability of numerous apps, the question that most traders ask is: Which is the best app for crypto trading in India? This comprehensive guide will explore the best apps for crypto trading, the legality of crypto in India, tax implications, and why Delta Exchange stands out as an excellent choice and best crypto trading india.

What is Delta Exchange India?

Delta Exchange is a cryptocurrency derivatives exchange that specializes in the trading of advanced instruments such as Bitcoin and altcoin futures, options, and perpetual swaps. For traders who need accuracy, it offers the following:

High liquidity.

Competitive fees.

INR deposit and withdrawal support.

is delta exchange legal in india

Yes, Delta Exchange is legal in India. Even though there are many uncertainties about the regulation of cryptocurrencies in the country, trading crypto derivatives is not illegal. Delta Exchange is registered with the FIU (Financial Intelligence Unit of India), and that makes sure it follows the anti-money laundering laws. But please do know that the platform is not registered under SEBI (Securities and Exchange Board of India) as SEBI does not yet regulate cryptocurrencies and their derivatives. Indian traders can use the platform legally provided they are in compliance with KYC and tax reporting guidelines.FIU Registration:

KYC Compliance: All the users are required to pass the KYC (Know Your Customer) procedure in this platform, which ensures legal and transparent trading.

Tax Reporting: Delta Exchange adheres to the TDS norms set by the government and offers reports to help users file taxes.

However, traders can legally use the platform by adhering to tax laws and KYC norms.

🎁 Save 10% Fees on Delta Exchange

For the next 2 months, you can enjoy a 10% discount on trading fees at Delta Exchange. Simply Sign Up with Code YIGRBW.

✅ Trusted FIU Registered | 💰 Lowest Trading Fees in India | 📱 Easy INR Deposit & Withdrawal

tax on crypto trading in india

Cryptocurrency trading is taxed under the Income Tax Act, according to the clarification from the government through the Union Budget 2022. So here’s how it goes down regarding crypto transactions and taxations.

1. Flat 30% Tax on Gains

The 30% tax rate is applicable to the income obtained by a person from transferring cryptocurrencies or by any other means such as trading. No cost or deduction will be allowed other than the cost of acquisition.

2. 1% TDS on Transactions

A 1% Tax Deducted at Source (TDS) applies to all crypto transactions above ₹50,000 per year (₹10,000 for taxpayers who are not audited).

The exchange deducts it at the time of the transaction

3. Losses from Crypto Trades Cannot Be Set Off

Losses from trading in cryptocurrency cannot be set off against other sources of income.

Every crypto asset is treated differently for tax purposes.

4. Reporting Crypto Income

Traders need to report the crypto income under the “Income from Other Sources” or “Capital Gains” category based on the frequency of trading.

How to Remain Compliant

Don’t end up in the legal books:

Maintain a record of all transactions, including date, amount, and wallet details.

Pay advance tax if the crypto income is high so that one doesn’t end up getting penalized.

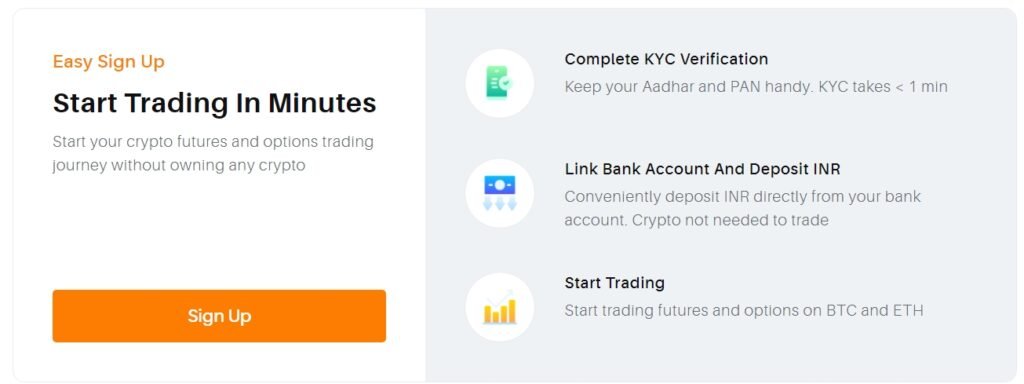

How to Trade Crypto on Delta Exchange India: Step-by-Step Guide for Beginners

Crypto Trading on Delta Exchange india app is hassle-free even for a fresher to cryptocurrency derivatives. Here is how you go about it:

Sign Up. Go to the Delta Exchange India website and create an account via your email address along with an appropriate password.

KYC process. Submit ID documents mandatory for identity verification.

Depositing Funds. You could deposit funds either in INR or in cryptocurrencies. For funding in INR, you need to use UPI as well as bank transfers.

Choose Trading Instrument: Make a selection from available products; these include Bitcoin futures, altcoin options, and perpetual swaps.

Place the Trade: Analyze market movements, choose your trading approach, either long or short, and enter your position

Monitor and Close Position: Keep up with market movements and close your position when you get to your target profit level or loss level.

🎁 Save 10% Fees on Delta Exchange

For the next 2 months, you can enjoy a 10% discount on trading fees at Delta Exchange. Simply Sign Up with Code YIGRBW.

✅ Trusted FIU Registered | 💰 Lowest Trading Fees in India | 📱 Easy INR Deposit & Withdrawal

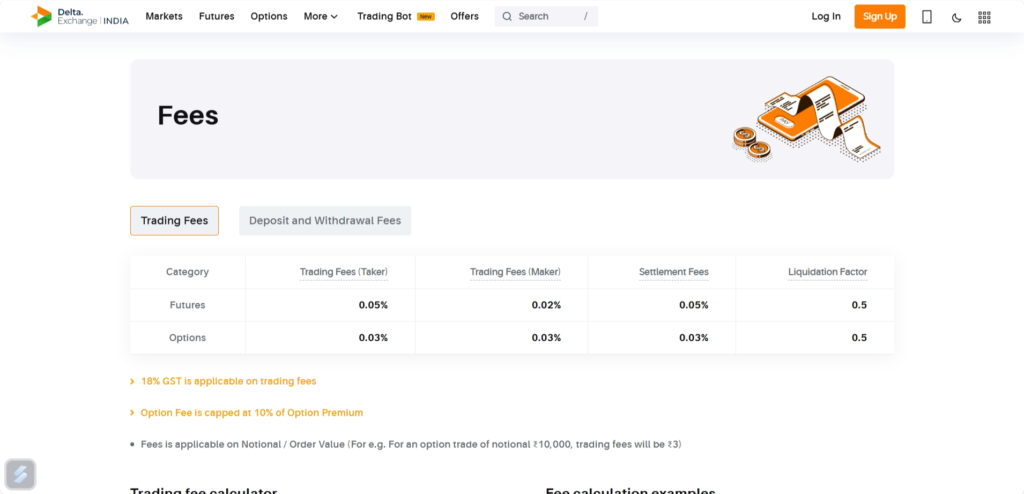

Delta Exchange India Fees and Commissions Explained: Low-Cost Crypto Trading

Delta Exchange is best crypto trading app in india for offering the best fee structure for competing against other exchange options, where traders wish to pay minimal fees. There are fees as listed below:

Maker Fees: 0.05%

Taker Fees: 0.10%

“Maker” means those who provide liquidity to the market, while “taker” refers to the ones taking the liquidity through executing an order. The low fees paired with deep liquidity ensure low-cost trading, especially among high-volume traders.

Delta Exchange India vs Other Crypto Platforms: Why Best App for Crypto Trading in India

The only global crypto platform that has a more India-focused approach is Delta Exchange. Here’s why it’s the best option for Indian traders:

INR Support: Traders can deposit and withdraw funds directly in Indian Rupees, which means they don’t have to pay any conversion fees.

Minimum Fee Charge: Delta Exchange boasts one of the lowest fee structures in the market, hence ideal for frequent traders.

FIU Compliance: The platform adheres to Indian regulations by being FIU-registered, giving Indian traders peace of mind.

Advanced Trading Tools: Futures and options are offered on the platform by Delta Exchange, that not many platforms offer in India. Thus, it offers very complex trading strategies.

🎁 Save 10% Fees on Delta Exchange

For the next 2 months, you can enjoy a 10% discount on trading fees at Delta Exchange. Simply Sign Up with Code YIGRBW.

✅ Trusted FIU Registered | 💰 Lowest Trading Fees in India | 📱 Easy INR Deposit & Withdrawal

How to Deposit and Withdraw Funds on Delta Exchange in INR

The deposit and withdrawal of funds in INR on Delta Exchange are easy. This is how to do it:

Deposit INR:

Access your account on Delta Exchange India.

Just Click on “Deposit” and select INR.

Use UPI or bank transfer to deposit funds into your account.

Withdraw INR:

Access the “Withdraw” section.

Enter the amount to withdraw and fill your bank details.

The system will then confirm the transaction and transfer the funds to your bank account.

Delta Exchange supports INR, thus making it easy for Indian traders and removing currency conversion hassle.

Delta Exchange India Futures and Options: How to Maximize Profits in Crypto

Delta Exchange offers both futures and options trading; through these, you will earn more as you go on to speculate price fluctuations or get rid of potential risks. Here’s how to use them:

Futures Trading: You can go for a long if you are anticipating the rise of the price or go for a short if you think the price will drop. Futures contracts give leverage so you can buy a bigger position with a smaller investment.

Options Trading: Options give you the right, but not the obligation, to buy or sell an underlying asset at a certain price. This can be a very good instrument in terms of managing risk, hence maximizing the potential gains.

In the use of these products, traders are able to enhance their strategies and take advantage of both bullish and bearish market conditions.

Is Delta Exchange india SEBI and FIU Registered? What Indian Traders Need to Know

Delta Exchange is FIU-registered, which means it complies with India’s anti-money laundering laws and financial regulations. However, it is not registered with SEBI, as cryptocurrency derivatives do not currently fall under SEBI’s regulatory purview. Despite this, Delta Exchange operates legallyDelta Exchange is registered with FIU, meaning it complies with the anti-money laundering laws and other financial regulations in India. However, it is not registered with SEBI since, currently, cryptocurrency derivatives are not within the regulatory scope of SEBI. Yet, Delta Exchange operates in a legal fashion in India and is trusted by traders who comply with the KYC and tax laws of the country.

Why Delta Exchange India is the Best app for crypto trading in india

Delta Exchange is the best platform for Indian crypto traders due to its focus on local needs. Here’s why:

- INR Support: Deposit and withdraw funds directly in Indian Rupees.

- Low Fees: Its maker and taker fees are among the lowest in the industry.

- High Liquidity: Execute large trades efficiently with minimal slippage.

- Advanced Products: Access to futures, options, and perpetual swaps, which are not commonly available on Indian exchanges.

- FIU Compliance: Operates legally in India, providing a safe and compliant trading environment.

- Delta Exchange is the best place for an Indian trader since it specifically caters to the need of a local. Here’s why:

- INR Support: Deposit and withdraw funds directly in Indian Rupees.

- Low Fees: Its maker and taker fees are among the lowest in the industry.

- High Liquidity: Large trades can be executed efficiently without much slippage.

- Advanced Products: Access to futures, options, and perpetual swaps, which are not commonly found on Indian exchanges.

- FIU Compliance: Operates legally in India, providing a safe and compliant trading environment.

🎁 Save 10% Fees on Delta Exchange

For the next 2 months, you can enjoy a 10% discount on trading fees at Delta Exchange. Simply Sign Up with Code YIGRBW.

✅ Trusted FIU Registered | 💰 Lowest Trading Fees in India | 📱 Easy INR Deposit & Withdrawal

Pros of Delta Exchange India:

Wide variety of trading instruments: The delta exchange provides futures, options, perpetual swaps, and yield products, allowing the traders to have a number of strategies both for hedging and speculation.

Low Fees: The platform has competitive fee structure (0.05% for makers and 0.10% for takers) which is very affordable for active traders.

High Liquidity: Traders can execute large trades smoothly without worrying about slippage due to deep liquidity.

User-Friendly Interface: The platform is intuitive in design, making it easy for beginners as well as professional traders to navigate and execute trades.

INR Support: Indian traders can easily deposit and withdraw funds in Indian Rupees (INR), making it more convenient for local users.

FIU Registration: Being registered with India’s Financial Intelligence Unit (FIU), Delta Exchange operates legally, thus ensuring transparency and compliance with AML regulations.

Security: The platform implements industry-standard security measures to ensure the safety of users’ funds and data, increasing trustworthiness.

Customer Support via Call: Delta Exchange app offers 24/7 customer support so that users can receive help whenever they require it.

Mobile: The website is accessible on mobile, making it possible to trade from the comfort of your phone.

Cons of Delta Exchange India:

Not SEBI-Regulated: While it is legal in India, Delta Exchange India is not regulated by SEBI as Indian authorities haven’t regulated cryptocurrencies and their derivatives yet.

Limited Fiat Options: Even though it does support INR, there are fewer fiat options on this platform than some other international exchanges, which could make the platform less accessible for some international users.

Overwhelming for Novice Traders: For new traders who aren’t accustomed to complex trading strategies like derivatives- futures and options may be quite overwhelming.

Crypto Regulations in India: The uncertainty of India’s cryptocurrency regulations may be a risk in the long term, although trading is currently legal.

KYC Process Required: The KYC verification process is necessary for compliance but might be inconvenient for users seeking instant access to trading.

Volatility Risks: Like any crypto exchange, Delta Exchange India trades with highly volatile markets, which can cause sudden and significant losses, especially for inexperienced traders.

🎁 Save 10% Fees on Delta Exchange

For the next 2 months, you can enjoy a 10% discount on trading fees at Delta Exchange. Simply Sign Up with Code YIGRBW.

✅ Trusted FIU Registered | 💰 Lowest Trading Fees in India | 📱 Easy INR Deposit & Withdrawal