Lump Sum SIP Calculator

Lump Sum SIP Calculator: Plan & Grow Your Wealth Smartly!

Among the more popular ways of earning wealth over a longer period of time is an investment in mutual funds. Even though SIPs have been designed to enable individuals to invest smaller amounts into their mutual funds at smaller, regular intervals, the reverse applies here – a lump sum is the other way round. A lump sum can generate returns based on a pre-specified time horizon for its investment, be that the first or the tenth. And that is exactly where the Lump Sum SIP Calculator can help. In this article, we’ll dive into what a Lump Sum SIP calculator is, how it works, and why it is important for investors.

What is a Lump Sum SIP Calculator?

A Lump Sum SIP Calculator is an online tool designed to help investors calculate the potential returns on a lump sum investment in mutual funds. It is not like a regular SIP where you invest a fixed amount periodically. In the case of a lump sum investment, a large amount of money is invested at one time. The calculator estimates the future value of your investment, considering the amount invested, the rate of return, and the period of investment.

How Does a Lump Sum SIP Calculator Work?

The Lump Sum SIP Calculator works on the formula basis of compound interest to determine the future value of an investment. It takes into account the principal amount-that is, the lump sum amount invested-and the expected rate of return and the time frame for which the investment is to be made. The formula used for compound interest is.

A=P×(1+100r)t

Where:

- A is the amount at the end of the investment period (future value).

- P is the principal amount (initial investment).

- r is the rate of return per annum.

- t is the time period in years.

Key Features of a Lump Sum SIP Calculator

Easy to use: most lump sum SIP calculators are easy to use so that any investor can enter the details of investment and get a quick estimate of returns.

Accurate Projections:These calculators utilize historical return data to give projections that are fairly accurate. Bear in mind that mutual fund returns are market-sensitive and, therefore, fluctuating.

Helps in Decision-Making: By calculating the future value of your investment, this calculator helps you make sound decisions about the amount that you would like to invest and the expected returns over a certain period.

Customizable: You may adjust the rate of return and time period to suit your goals and expectations from an investment.

How to Use a Lump Sum SIP Calculator?

It is quite easy to calculate using a lump sum SIP calculator in a few simple steps:

Enter the Investment Amount: First, you need to enter the lump sum amount you want to invest. This may be a one-time amount you are willing to invest in a mutual fund.

Choose the Expected Rate of Return: Next, you need to enter the expected rate of return. Most calculators allow you to use an average return rate, but it is essential to be realistic and consider market conditions.

Set the Investment Period: Specify the number of years you plan to keep your investment. The longer the investment period, the better the returns, as compound interest works its magic.

Click ‘Calculate’: Once you put in all the details, then click the ‘Calculate’ button to get the value of your investment in future.

Review the Results: With the use of a calculator, you should be able to know your approximate amount to receive when the investment term ends in order to help you compare your lump sum investment potential.

Why Should You Use a Lump Sum SIP Calculator?

Understand Potential Returns: A lump sum SIP calculator gives you a clear picture of the returns you can expect from your lump sum investment. This helps you plan better and make changes to your investment strategy.

You can track: the investment growth by comparing different investment scenarios. This would help you determine how your lump sum investment grows over time and if you need to increase the investment or your expectations.

Make Informed Decisions: Investing large sums of money requires careful planning. Using the calculator helps you understand the future value of your investment, which makes it easier to decide how much money to invest and for how long.

Time Value of Money: A lump sum investment can earn huge sums with the help of the time value of money. The calculator demonstrates the working of compound interest so that you can imagine how your investment grows exponentially with time.

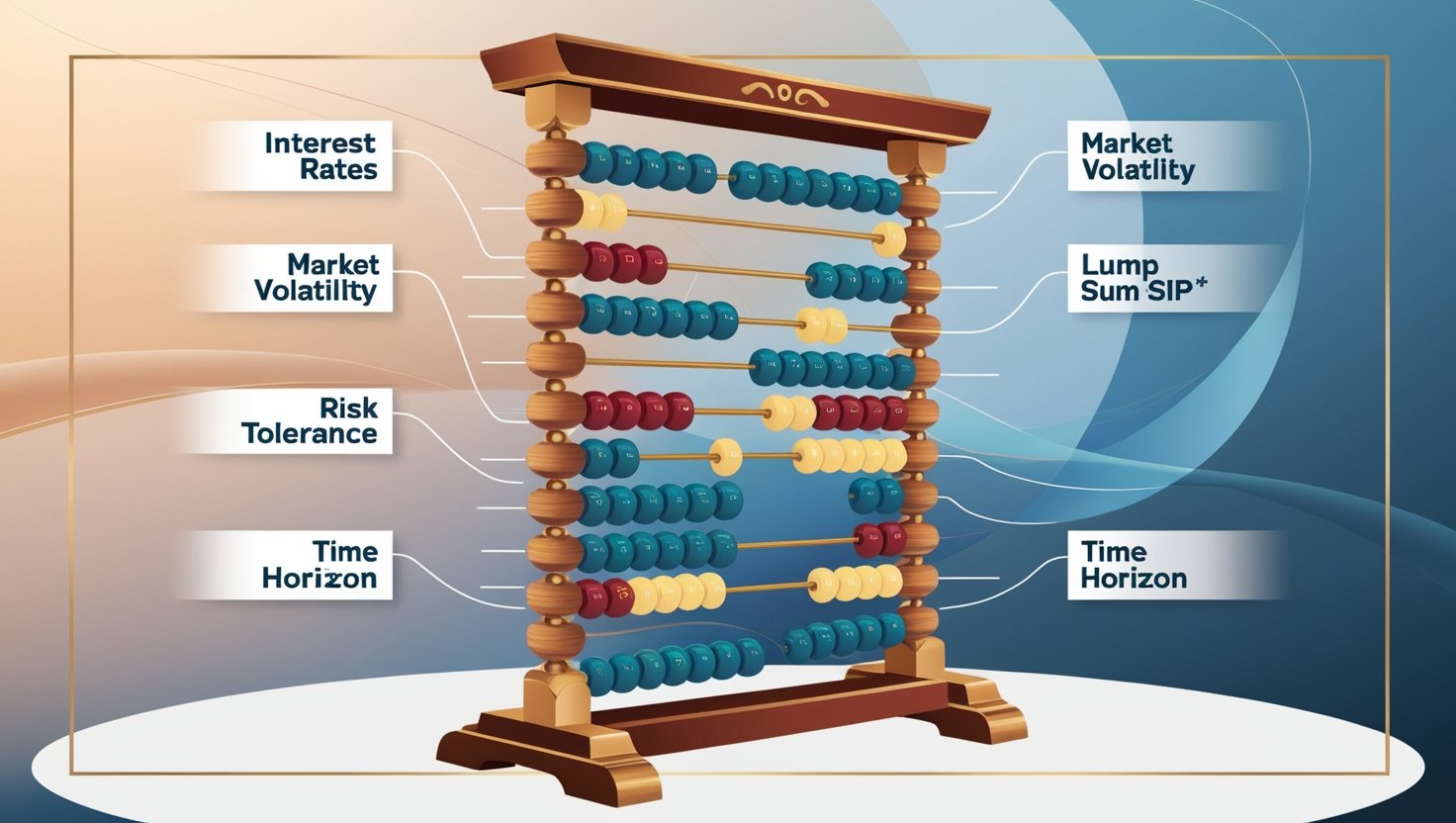

Factors That Affect Lump Sum SIP Investment Returns

While a Lump Sum SIP Calculator provides useful projections, several factors can affect the actual returns on your investment:

Market Volatility: Mutual funds are prone to market risks. Returns can vary with the market conditions prevailing at the time of investment.

Rate of Return: A key determinant of your investment’s growth is the rate of return. The greater the returns, the greater will be the growth, though returns are never guaranteed.

Investment Period: The investments generally give better returns, where compound interest has time to work.

Fund Selection: You also need to consider the specific mutual fund you will pick. This can significantly influence your returns, as more historically successful funds might present better growth potential.

Conclusion

Prudent investment is one of the pillars of money planning, and a lump sum SIP calculator proves useful along the way. Whether you’re a seasoned investor or a beginner, it is essential to understand how your money can grow over the years from a lump sum investment in terms of mutual funds. Finance is a rapidly changing part of life, and investment decisions based on data avoid you from incurring any loss along with the assurance of maximizing returns. Using a lump sum SIP calculator, you don’t have to guess anything and make decisions based on accurate projections and future value calculations.

The greatest advantage of using a lump sum SIP calculator is that it gives you clarity on how an investment that is made once can evolve over time. Instead of relying on assumptions or general market predictions, this calculator gives you concrete calculations based on factors like interest rates, investment time frame, and expected returns. This allows investors to make well-informed financial decisions that are aligned with their goals—whether accumulating wealth, retirement planning, or achieving financial independence.

A lump sum investment, when invested wisely in mutual funds, can yield astronomical returns, especially when compounded over the long term. However, without proper planning and analysis, investors might struggle to optimize their portfolios. This is where a lump sum SIP calculator can come in. Not only does it help investors see how much money they will have in the future, but it also enables them to compare different investment options and choose the most lucrative one.

Risk assessment forms another integral part of financial planning. All investments in mutual funds can provide the same returns, and market volatility can influence overall growth. A lump sum SIP calculator provides the investor with control by allowing them to try out different market conditions and observe how interest rate fluctuations and tenure impact the final corpus. Such a process of analysis positions investors well even when the market is volatile because they have an estimate of what can ensue.

Also, the lump sum SIP calculator is a wonderful tool for goal-based investing. The majority of individuals invest with specific financial objectives, such as buying a house, funding education, or saving for a secure retirement. By entering their target amount and investment horizon into the calculator, they can determine how much they need to invest now in order to achieve their future objectives. This feature makes it easier to stay disciplined regarding long-term financial plans and track progress through the years.

Additionally, the simplicity of use and availability of a lump sum SIP calculator render it an invaluable tool for contemporary investors. Found online, such calculators are developed with intuitive interfaces, allowing anyone to compute possible investment returns in mere seconds. The capacity to easily modify inputs, contrast scenarios, and view results makes the decision-making process easier and builds confidence among investors.

Financial planning and literacy go hand in hand, and an SIP lump sum calculator encourages both. It brings investors into the proactive mode, conscious of the power of compounding, and make informed decisions that are appropriate for their financial objectives. Without them, the majority would find themselves underinvesting, leading to an opportunity loss, or overinvesting in an uninsured product without a plan, which can jeopardize their financial security.

Simply put, a lump sum SIP calculator is not merely a calculation machine—it is the gateway to smarter investment, better financial planning, and long-term wealth creation. It helps investors visualize their future finances, set realistic goals, and steer their investment path with confidence. If you have ever been in two minds about where and how much to invest, using a lump sum SIP calculator is on the right track. With its assistance, you can invest wisely in line with your financial objectives, preparing a prosperous and secure future. Start using this tool today and take the control of your investment process with confidence and clarity!